According to a study by Forrester, “business expense management is the second most challenging operation to control.”

This indicates that most businesses are still facing complexities with their expense management process.

Nowadays, employees incur most expenses on behalf of the company. This expenditure is categorized as a business expense. For example, employee expenses on hotels and flights while making business trips or purchasing software subscription services.

The task of managing business expenses usually falls under the finance department. They have to ensure their business balances a fine line between spending effectively and cutting back on costs.

The finance team is also responsible for ensuring their expense management process is effective and streamlined to mitigate costly mistakes. For this, they can work with a system of their choice to ensure seamless expense management.

While an outdated system can prove to be more work, opting for a modern automated expense management software can help them identify potential problems and cut back costs.

What is expense management?

Expense management is a set of business processes to record and track business expenses, make payments, and track expenses. These expenses typically include employee travel expenses like per diems, cash advances, mileage, and other office-related expenses.

In essence, an expense management process includes creating Travel and Expense (T&E) policies, enforcing it, and monitoring business expenses.

Why is expense management important?

Expenses are an essential part of keeping a business running. Thus, companies need to have a process in place to keep their expenses in check. Having an effective expense management process in place can help businesses to:

- Keep track of employee spending

- Stay compliant with legal tax authorities

- Increase employee compliance with expense policies

- Enhance employee morale and productivity

- Identify potential risks and opportunities

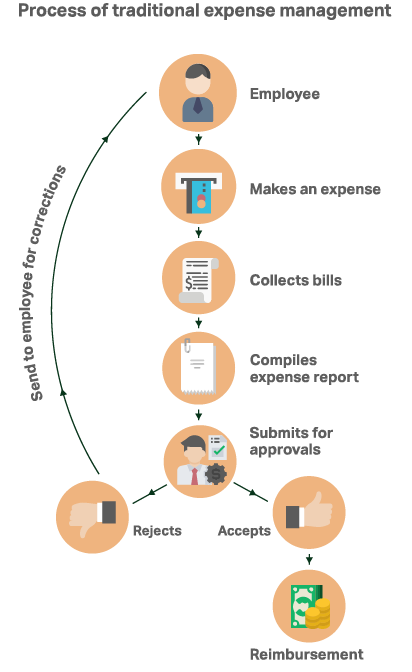

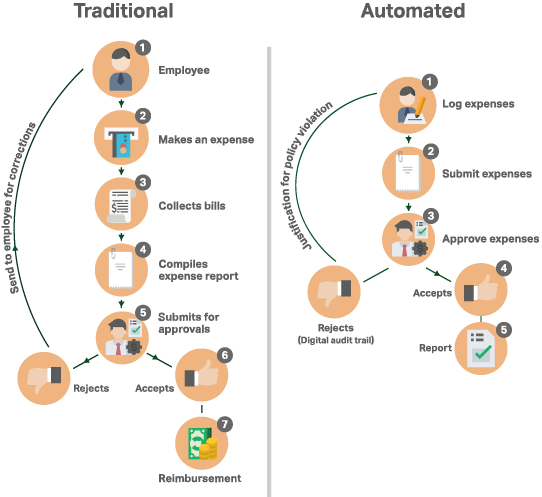

Process of traditional expense management.

The expense management process is long-winded but a necessary one.

Every company has some sort of expense management process in place. The finance teams can use either pen and paper, spreadsheet, or an expense management software for expense reporting.

Here’s what a traditional expense management process with a pen and paper, or with a spreadsheet looks like:

1. The employee submits expense reports

Employees can request reimbursement from the employer for any work-related expenses such as business trip expenses, travel expenses, mileage, etc. To do so, they have to submit expense reports.

An expense report is a form detailing the amount an employee has spent, the merchant’s name, date, purpose, and other expense-related details. An expense report should also include all the supporting documents, such as bills and receipts.

In a traditional expense management process, for an employee to submit their expense report, they have to:

- Keep track of all the fragile paper receipts

- Print all the receipts along with the expense report form

- Collate the expense report and receipts according to date of expenses

- Ensure all the receipts tallies with the amount in the expense report

- Verify the amount to ensure it is within the allowable limit

2. The manager reviews the expense reports

After an employee submits an expense report, either a supervisor or a manager has to review and approve the expense report. An approver manually goes through each expense report and ensures the expense report qualifies for reimbursement.

Components to check in an employee expense report:

- The expense amount is within the allowable limit

- There are no missing receipts, bills, or invoices

- There are no fictitious or duplicated claims and receipts

The manager can reject an expense report if it violates company expense rules and regulations. For example, an expense report can get sent back if the amount is above the limit or if the receipt is missing. The employee then has to reevaluate and rework before resubmitting the report for approval.

After reviewing the expense report, the approver approves the report if the expense report checks all the right boxes.

3. An auditor audits the submitted expense reports

In most organizations, an auditor’s role is to ensure tighter controls, drive policy compliance, and reduce the possibility of fraud. The auditor in an organization is responsible for verifying receipts and reviewing debatable expense reports.

In the traditional expense management process, an auditor scans through each report manually. They ensure no errors slip pass, and the reports are within the policy guidelines. In case there are some errors, the auditor has to communicate the correction to the rightful employee or the manager.

After identifying the right person, the expense report is sent back for correction. If the auditor finds no errors or violations after auditing, the expense report is sent to the finance team for payment processing.

4. Finance team process the expense report for reimbursement

After the expense report has gone through checks and approval, the expense report can be finally processed for reimbursement by the finance team. The team then needs to ensure they go through each report and record all expenses in their spreadsheet.

Once they’re done manually keying in all the employee expense data, the finance team starts processing the expense amount to reimburse employees.

Challenges in traditional expense management.

Relying on a traditional expense management system might work for an organization to an extent, but it can affect its financial health in the long-run.

Pen and paper or spreadsheet-based expense management involve a lot of manual work. Not only does it take up additional work hours from employees, but it can also open doors for more inefficiencies and inaccuracies.

Some of the common challenges associated with managing expenses with an outdated system are:

1. Prone to multiple data entry errors

In an outdated expense management system, the entire expense reporting process to the expense reimbursement process consists of manual work. When a whole operational process is manual-based, it can be effortless for errors to occur and slip pass.

For example, after an employee returns from a trip, he/she sits for hours working on their expense report. They can easily overlook a policy violation, such as overstating the expense amount. When an approver or auditor finds the error, the report is sent back, and they have to rework the entire report just because of an unintentional mistake.

Manual data entry can occur from the accounting end as well. When an expense report is approved, the accountant has to key all the expense data, including the expense amount, into their spreadsheet. A simple error such as a duplicate entry or an accidental “0” can cause an imbalance in their numbers.

Even the greatest caution from both the employees and the finance team can't guarantee a clean sheet with manual expense management. This is because manual data-entry is very prone to errors, and it can occur from any end.

2. Companies have difficulty enforcing their expense policies

Almost every organization has its custom-made company policies. Finance and the HR department usually spend a considerable amount of time crafting guidelines to ease their employees’ lives. Especially concerning expense management, policies are very crucial. Finance teams can spend hours creating expense policies and revising them.

But no matter how comprehensive an expense policy may be, it can render the policy useless if it isn’t implemented correctly. In manual expense management, the finance team can have a hard time enforcing new policies and gaining employee compliance.

A company can also be especially vulnerable to expense fraud and scam if they have a loose policy and poor enforcement. It can encourage employees to take advantage of such cases. Also, with manual policy enforcement, employees and approvers alike may find it challenging to remember all their policies. For example, employees can easily overspend if they aren’t sure about their expense limit. It can lead to unintentional violations and loss in time and money.

3. Businesses can incur hidden operational costs

Costs incurred in the manual expense management processes mainly consist of two factors: employee hours and manual errors. An expense management process involves almost all the employees in an organization.

- Employees have to spend time printing, collating, and creating their expense reports

- Approvers and finance teams have to manually go through each employee expense reports to ensure policy compliance

On an individual level, employees can spend hours doing manual tasks and take their focus away from what’s important. Companies can be slow to grow and innovate on a business level since they spent hours dealing with operational friction.

Using a manual-based expense management system also open doors for a company to incur losses through:

- Expense fraud: A fraudster can easily get away with ripping off a company for a long time with a manual expense management system. With loose policy enforcement and poor policy checks, fraud can easily pass unnoticed for a long time.

- Lost expense receipts: Lost receipts can mean two things: employees lose out on reimbursements, and the company loses out on tax savings. Not only that, lost receipts also mean there is no proof of expenses, and there is no way to track and verify budgets.

- Out of policy expenses: Most times, employees can take advantage of their weak expense processes and spend more than they should. But whatever their reasons may be, companies end up paying to keep their employees satisfied.

4. Poor visibility into the entire process

An expense management process can be a long and time-consuming process with multiple manual tasks and processes. Any slight intervention can cause significant delays in the process and take up employees’ additional hours.

An outdated expense management process also provides zero visibility for both ends- employees and finance teams. This can cause frustration, affect productivity, and morale for both employees and finance teams.

For employees:

- After submitting their expense report, there is no way to know if it has been approved for reimbursement

- They have no clue about the status of their expense report and reimbursement

- They are left in the dark and can cause frustration if the reimbursement takes a long time

For finance teams:

- They are clueless about the type of expenses employees are incurring until they receive the expense reports

- They have to chase employees to remind them to submit reports or review an expense report

- Preparing for tax season and following a stringent deadline can be a challenge since they receive last-minute submissions and corrections

5. Employee reimbursements are delayed

A traditional expense management system involves a lot of manual hard work from employees and finance teams.

- Employees spend hours gathering receipts and preparing their expense reports.

- Finance teams have to go through each expense report ensuring it follows the company policy guidelines.

- After approving the expense reports, they manually enter all the expense details into their database for recordkeeping.

Such processes are prone to error and fraudulent activities via manual data entry.

- Employees can key in the wrong expense amount that doesn’t match with the receipt

- It can become easy for an employee to claim multiple reimbursements or exaggerate their expenses

- Finance teams can easily miss fake claims and expense claims that are against their company policies

- The finance team can key in the wrong numbers into their system

There is a lot of hard work that goes into expense management, but it doesn’t always necessarily translate into an on-time delivery.

Manual expense management activities are time-consuming yet prone primarily to error. Finance teams and employees can go back and forth, clarifying, enquiring, and making corrections. But all that can take up more time and further increase the reimbursement turnaround time.

Tackling expense management challenges with an automated expense management software.

Relying on an outdated expense management system can do more harm than good. There are various challenges in managing business expenses, and a traditional system just won’t cut it.

Companies can overcome their expense management challenges by opting for a more advanced solution. They can look into automating their process by adopting an expense management software such as Fyle.

An expense management software helps automate the expense management process and comes with features that can provide added advantages. For example, Fyle has real-time policy checks that audit expense reports even before employees send it for approval.

Let’s look into some of the features that Fyle offers to enable seamless automated expense reporting.

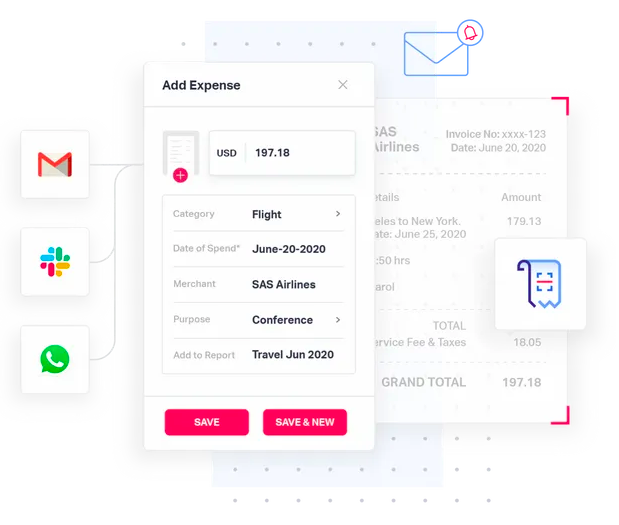

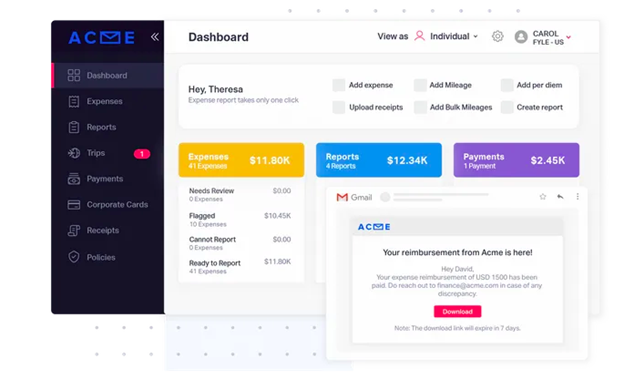

1. Easy expense reporting for employees

In a manual expense reporting process, employees spend countless hours putting their expense reports together. It involves mundane tasks like printing, collecting, and collating receipts and reports under one expense report form.

Often, employees put aside expense report submissions for the last minute as they have to spend so much time and effort on it. This can add to delays in reimbursements and also cause multiple errors in the process.

With an automated expense reporting software such as Fyle, employees don’t have to spend more than a minute doing the task. With Fyle, employees can eliminate all the mundane tasks while ensuring error-free reports and faster expense report submission.

Fyle allows employees to instantly submit both paper receipts and e-receipts in just a click of a button. Here’s how:

Using the Fyle mobile app:

Paper receipts are very fragile and can be easily damaged or misplaced. If employees lose their receipts, it is unlikely that they will be able to claim reimbursement for their expenses.

Fyle provides the solution for employees to create an expense report on the spot without holding on to paper receipts. Employees can use the Fyle mobile to capture any paper receipts and turn them into a digital receipt.

Here’s how it’s done.

- Open the Fyle mobile app and hold the paper receipt in front of the phone camera

- Take a picture of the paper receipt

- Fyle uses OCR technology to capture, scan, and extract all necessary details from the receipt

- Once the details are extracted, Fyle auto-fills the expense report with all the expense information such as amount, merchant details, and type of expense

- The receipt also gets automatically attached to the expense report

- An employee then has to just review and submit the expense report for approval

Using the Fyle email add-on

Nowadays, employees usually get receipts of their purchases directly in their mailboxes. Uber or Lyft receipts are some common examples. ,

If a business uses an outdated system, employees have to either print and attach the receipt to their form or tag the finance team in a long email thread. With thoughts of such a tedious process, employees can choose to hoard receipts in the mailbox for a long time resulting in delays.

Using the Fyle email add-on, neither the employees nor the finance team has to do any extra work. The Fyle email add-on is available both for Gmail and Outlook users. The email add-on simply sits in the inbox and reads the e-receipt when they want to report their expenses. (PS: Don’t worry, it doesn’t snoop around your mailbox.)

This is how users can report expenses within their mailbox:

- Open the mailbox and click on the Fyle email add-on

- Using the same OCR technology as Fyle’s receipt scanning feature, it scans, captures, and extracts information from the digital receipt

- Fyle then auto-fills the expense report form and attaches the e-receipt along with it

- The user simply needs to review the details and can submit the report for review

Using messaging platforms:

Apart from the Fyle mobile app and email add-on, employees also can create an expense report via text message, Slack, and Whatsapp. To create an expense report, the employee simply needs to forward their receipt through text message, Slack, or Whatsapp to a unique Fyle number.

After doing so, Fyle automatically creates an expense report for the user. Next, all the user needs to do is review the details and submit the report to claim their reimbursement. It’s that simple!

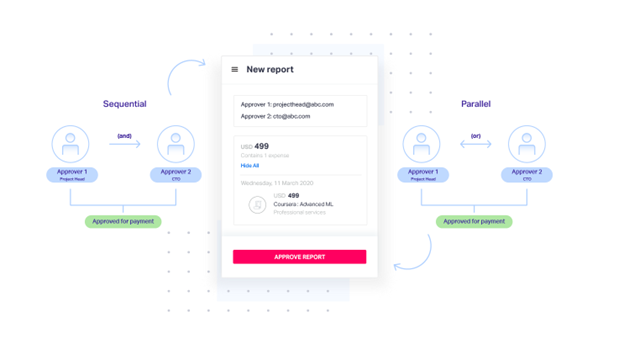

2. Automate your entire expense approval workflow

There can be many back and forths between employees, approvers, and the finance team in a manual set-up. For example, if the finance department requires clarification for an expense report, they must either go after the approver or the employee.

Also, in some cases, employees forget to submit their expense report, or approvers may take more time to review reports. This leads to the finance team chasing employees to do their tasks to close books on time.

All this not only takes up their time but can create a lot of confusion in the process.

But all that can be made easier with the help of an expense management software. With Fyle, the finance team can easily set up an automated expense approval workflow. Fyle provides the finance team with the flexibility to define their workflow as per their company hierarchy.

Using Fyle, the finance team can set up their automated workflows. By doing so,

- After an employee creates an expense report and submits it, the reports are auto-directed to their respective approver

- The approver can review the report, and in case the reports violates company policy, it can be sent back for inquiry within Fyle itself

- In case everything checks out, the approver can approve the report. The reports get automatically routed to the finance team for payment processing.

The finance team can also use Fyle to remind employees to report their expenses and approvers to review the expense reports. They can perform these functions within the expense management software itself and from their office or home's comfort. No one has to spend time going desk to desk for inquiry, clarification, or updates.

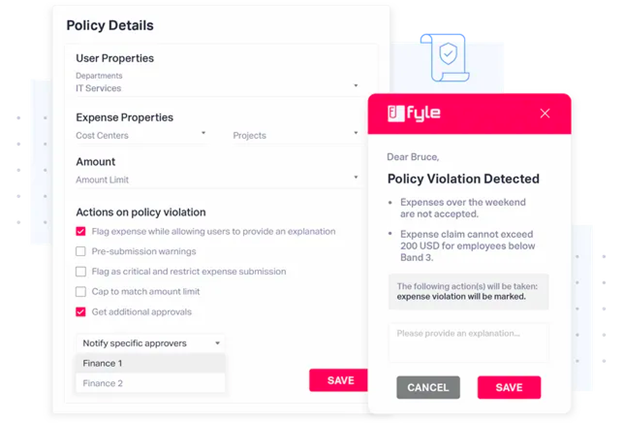

3. Reinforce company policies and increase expense policy compliance

One of the biggest challenges for finance teams is enforcing their expense policies. They spend hours making the ideal expense policy for their company but fail to implement it vigorously.

Using an expense management software, the finance team can overcome this challenge. Fyle comes with a robust policy engine that can make the life of the finance team easier. Through Fyle, finance teams can:

- Integrate their company policies within the system no matter how complex it is

- Define parameters according to the employee level and expense type

- Create expense policies specific to mileage, per-diem, cash advance, trips, etc

- Determine the action to be taken in case of mild or severe violation

After implementing company expense policies into Fyle, the policies are enforced immediately. Fyle policy engine runs silently within the software and flag policy violations in real-time. For example, if an employee tries to submit a duplicate receipt, the error is immediately notified to the employee. The employee can then go on to delete the same entry.

Fyle also notifies the employee in real-time while creating an expense report. For example, say, a company’s allowable limit for lunch in a day is $50. If an employee tries to make an expense report for lunch above $50, it notifies the employee to correct it.

With Fyle as a policy check engine, employees are more aware of policy violations and are more careful while creating expenses. It also means employees make lesser errors while reporting their expenses and are more likely to comply with company rules.

4. Document every business expense in one place

For employees, tracking and managing their receipts is one of their biggest expense management challenges. Even if they maintain a dedicated drawer just for receipts, it can still be easily displaced or damaged.

For the finance team, it can be a challenge to maintain paper-based receipts and expense reports. Not only that, storing and accessing all the documents can be problematic sometimes, especially since not everyone has access to it.

Fyle offers a solution to receipt management woes for both employees and the finance team through cloud storage.

- When an employee submits an expense report, the report along with the receipts are stored in the cloud

- Employees don’t need to provide physical copies of receipts and expense reports to their approver or finance teams

- All stakeholders can easily access employee reports through the Fyle dashboard

- Finance teams can access documents anywhere, anytime, and from any device

- Finance teams can easily manage expense documents under a centralized storage space

- Fyle also provides a digital audit trail of all expense reports. This means all the history and logs of an expense report is recorded in the software.

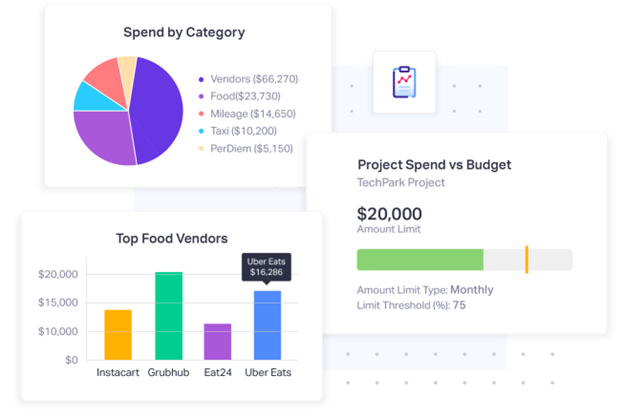

5. Gain insights with data analytics

Businesses can gain a lot of qualitative and quantitative insights from their employee expense reports. They can use the data to make informed decisions that can bring profits and cut costs.

With all the expense data, managers can make calculated evaluations, gain new perspectives, uncover spending trends and patterns, and identify risks and opportunities.

Gaining these insights with a manual expense management process is close to impossible. It can overwhelm finance teams, and despite all time spent skimming through hoards of expense reports, inaccurate predictions can occur.

Fyle comes with a powerful analytics tool that empowers finance teams by giving them a bird’s eye view on the entire process.

- All the expense reports submitted by employees are gathered and compiled together under one dashboard.

- Fyle comes with an intuitive and customizable dashboard. The finance team, manager, or executive can use a variety of filters to review past purchases and view current spending trends.

- With Fyle, an organization can drill down spending patterns from a macro level to an individual level.

- Businesses can view the areas where expenses occur the most, departmental spending, top violators, top spenders, and more.

- Finance teams can identify opportunities for partnerships with vendors for discounts.

- Data analytics can also be used to spot loopholes in the expense policy to avoid potential fraud.

- The expense analytics tools give more transparency into business expenses and can aid in taking informed decisions.

Benefits of implementing an automated expense management software.

1. An expense management software empowers employees to perform expense-related tasks while on the move

Before implementing an automated expense management solution, employees and finance teams were tied to their desks doing mundane expense-related tasks. But with the arrival of software such as Fyle, employees can be both mobile and productive.

With Fyle’s mobile app and cloud technology,

- Employees can report expenses even while traveling in a cab

- Finance teams can access and view reports from the comfort of their home

2. An expense management software speeds up the entire approval and reimbursement process

A lot of back and forths can occur between employees and finance teams, ranging from minor to major policy violations. The finance team can also spend a considerable amount of time chasing employees to submit or review reports. All this can add up to additional time being spent, which further leads to a delay in employee reimbursements.

An expense management software allows employees and finance teams to resolve issues in real-time under one system. The finance team can also send auto-reminders to employees and approvers to perform their tasks on time.

3. An expense management software eliminates the chances of human error

An automated expense management software can take over the entire mundane manual process, such as data-entry, policy checks, and credit card reconciliations. These tasks are time-consuming as well as error prone. An expense software like Fyle automates manual tasks and gets the job done more efficiently.

4. An expense management software allows businesses to be compliant with both internal and external bodies

Businesses have to ensure they comply with their internal policies and external bodies, such as their local tax organization. With Fyle, the finance team can enforce their policies within their organization seamlessly. Our robust policy engine runs checks in real-time, auto-flags errors, and ensures no policy violations slip through.

5. An expense management software helps businesses to detect and prevent fraud

Potential expense fraud can occur when organizations don’t have a robust policy check in place. Businesses can use Fyle’s policy engine to curb fraud in real-time. They can also leverage their expense data with Fyle’s data analytics to identify potential risks and threats to their company.

Implementing a modern expense management software.

Companies struggle to maintain and manage their expense management process because they fail to identify and address the process's complexity. They may choose to stick to a spreadsheet-based system since they’ve grown familiar with it and see it as a simple way to handle the process.

But an outdated approach brings more unseen challenges that can slow down productivity, increase hidden costs, and waste valuable time and effort.

Switching to a modern expense management software solves issues that businesses face with the entire expense reporting, tracking, and managing process. AI and cloud-based expense software such as Fyle can:

- Take care of manual data entry work

- Help automate and streamline the entire workflow process

- Enforce T&E policies

- Curb potential errors, fraud, and threat

- Provide valuable insight for business growth

In summary, an automated expense management software can make the entire process of expense reporting a breeze. It can take care of tasks that require less human attention so that employees can focus on their work. By implementing an expense management solution, businesses can save on resources and scale as they grow. It’s time you do too.

Author bio: Akhono Seleyi is a Content Marketer from Fyle, an AI expense management software company designed to put an end to your expense reporting and management woes.

Hopefully, this post gives you something to work with while trying to understand NetSuite and what it can do for your business. If you have any questions and want some free consulting advice, feel free to contact our team at Anchor Group.